Introduction: Why Financial Planning is Essential

Financial planning is the foundation of a secure and stress-free life. It helps you manage your income, control expenses, grow wealth, and protect your future. Whether you’re a young professional, business owner, or starting a family, understanding financial planning can empower you to make informed money decisions. This guide will break down the importance of financial planning and how you can get started.

What is Financial Planning?

Financial planning is a systematic approach to managing your finances to achieve specific life goals. It includes budgeting, saving, investing, insurance protection, retirement planning, and estate planning. A solid financial plan ensures that you are prepared for life’s uncertainties while growing your wealth over time.

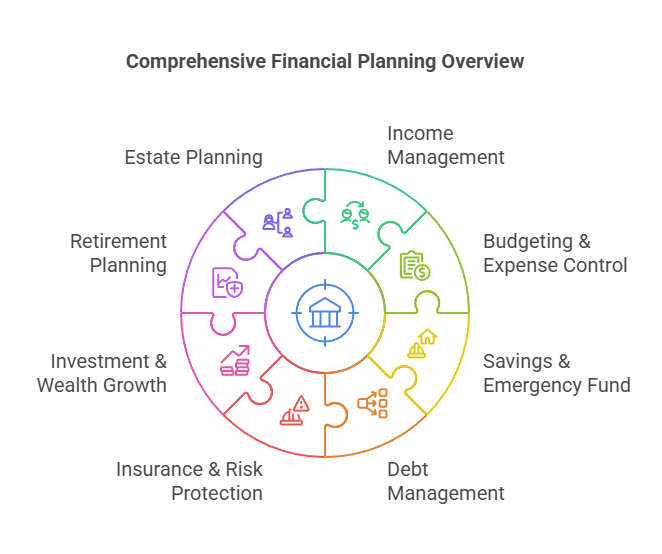

Key Components of Financial Planning:

- Income Management – Understanding and maximizing your earnings.

- Budgeting & Expense Control – Tracking spending to avoid financial strain

- Savings & Emergency Fund – Preparing for unexpected expenses.

- Debt Management – Paying off loans and credit card debt effectively.

- Insurance & Risk Protection – Safeguarding against unforeseen events.

- Investment & Wealth Growth – Building long-term financial security.

- Retirement Planning – Ensuring financial freedom in your golden years.

- Estate Planning – Protecting and distributing your wealth efficiently.

The Benefits of Financial Planning

1. Gives You Financial Security & Peace of Mind

Having a plan in place helps you manage risks, protect your assets, and ensure financial stability in case of emergencies. Knowing that you have a structured financial strategy can reduce stress and anxiety about money.

2. Helps You Set & Achieve Financial Goals

A clear plan allows you to prioritize short-term and long-term goals such as buying a house, funding education, or retirement planning. Without a financial plan, it’s easy to lose track and delay important milestones.

3. Avoids Unnecessary Debt & Improves Cash Flow

Proper financial planning helps you track spending and avoid accumulating unnecessary debts like high-interest credit cards. Managing cash flow effectively allows you to allocate money towards investments and savings rather than paying off debt.

4. Maximizes Wealth Growth Through Investments

With a financial plan, you can make informed investment decisions, ensuring your money works for you and grows over time. A diversified portfolio, when managed wisely, can help you generate passive income and achieve financial independence faster.

5. Prepares You for Emergencies

An emergency fund, insurance policies, and proper risk management strategies protect you from financial disasters caused by job loss, medical emergencies, or economic downturns. Life is unpredictable, and financial planning ensures you’re ready for whatever comes your way.

6. Ensures a Comfortable Retirement

Financial planning helps you build retirement savings so you can enjoy financial freedom when you stop working. Many people underestimate the amount they need for retirement, and early planning ensures you won’t run out of money in your golden years.

7. Protects Your Legacy Through Estate Planning

A proper estate plan ensures that your wealth is distributed according to your wishes and minimizes legal complications for your heirs. Without estate planning, your loved ones may face financial and legal challenges when managing your assets after your passing.

Common Financial Planning Mistakes to Avoid

1. Not Having a Budget

Without a budget, overspending is inevitable. Many people don’t track their expenses, leading to financial struggles. A budget helps you control spending and ensure you live within your means.

2. Ignoring Emergency Savings

Not having a financial safety net can lead to debt during crises. Aim to save at least 3-6 months’ worth of living expenses to prepare for unexpected situations.

3. Delaying Investments

The earlier you start, the more your money grows due to compounding. Many people wait too long to invest, missing out on potential returns. Even small investments early on can yield significant results over time.

4. Underestimating Insurance Needs

Medical bills, accidents, and unforeseen events can ruin financial stability. Having adequate life, health, and critical illness insurance ensures you and your family are financially protected.

5. Failing to Plan for Retirement

Relying solely on EPF or pension may not be enough. A retirement plan with diversified investments ensures you have sufficient funds to maintain your lifestyle after retirement.

6. Not Reviewing Your Financial Plan Regularly

Financial needs change over time, so regular reviews are crucial. Life events such as marriage, having children, career changes, or economic shifts may require adjustments to your plan.

How to Get Started with Financial Planning

1. Assess Your Current Financial Situation

Calculate your income, expenses, savings, debts, and assets to understand where you stand. A financial snapshot helps you identify areas that need improvement.

2. Set Clear Financial Goals

Define short-term (e.g., clearing credit card debt) and long-term goals (e.g., buying a house, retirement savings). Having specific and measurable goals keeps you motivated and focused.

3. Create a Budget & Track Expenses

Use budgeting tools or apps to monitor where your money goes and adjust spending habits. A well-structured budget ensures you allocate funds to essential areas such as savings and investments.

4. Build an Emergency Fund

Aim to save at least 3-6 months’ worth of living expenses to cover unexpected financial setbacks. This prevents you from relying on credit cards or loans during emergencies.

5. Manage & Reduce Debt

Prioritize paying off high-interest debts first to reduce financial burdens. Consider strategies like the debt snowball or avalanche method to clear your loans efficiently.

6. Invest for Long-Term Growth

Start investing in diversified assets such as unit trusts, stocks, or real estate to grow wealth. The earlier you start, the better your returns due to the power of compounding.

7. Get the Right Insurance Coverage

Ensure you have life, health, and critical illness insurance to protect yourself and your family. The right coverage prevents financial strain in case of medical emergencies or unexpected loss of income.

8. Plan for Retirement Early

Consider contributing to Private Retirement Schemes (PRS) and maximizing EPF savings for a comfortable future. Planning ahead ensures you don’t struggle financially after retirement.

9. Review & Update Your Financial Plan Regularly

Life changes (marriage, children, job changes) require adjustments to your financial strategy. Regularly reassessing your plan ensures you stay on track toward achieving your financial goals.

Conclusion: Take Control of Your Financial Future

Financial planning is not just for the wealthy—it’s essential for everyone. By taking small, consistent steps today, you can build a financially secure future for yourself and your loved ones. Start by setting goals, budgeting wisely, protecting yourself with insurance, and investing strategically. The sooner you begin, the better your financial future will be!

Book a free consultation!

Leave a comment