Every year on 16 September, Malaysians across the country celebrate Malaysia Day, a reminder of our unity, diversity, and shared future. But while our national progress is worth celebrating, there’s another type of progress that often gets overlooked: our personal financial health.

—> Because here’s the truth:

A strong nation is built on the strength of its people, and that includes financial strength.

Why Your Finances Matter for the Nation

When individuals are financially secure, they:

- Spend more confidently, boosting the local economy

- Contribute to government revenue through taxes

- Rely less on subsidies and social aid

- Are better equipped to invest in businesses, education, and innovation

But right now, many Malaysians are struggling.

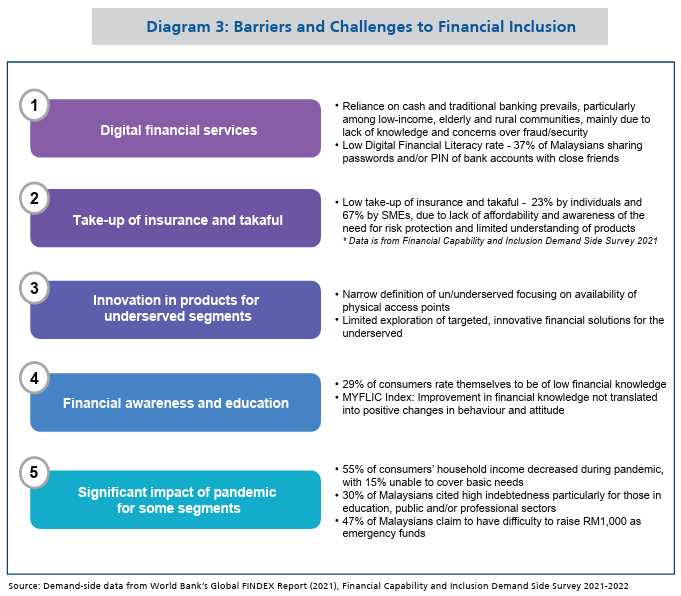

According to Bank Negara Malaysia, over 47% of Malaysians have difficulties raising RM1,000 in an emergency, and household debt remains among the highest in Asia.

This means that while we wave the Jalur Gemilang with pride, many of us are quietly stressed about our wallets.

The Link Between Financial Literacy and National Strength

Financial literacy isn’t just about budgeting or investing. It’s about making smart decisions that protect your family and contribute to the country’s long-term prosperity.

When more Malaysians:

- Avoid excessive debt

- Save and invest regularly

- Protect themselves with insurance

- Plan for retirement and estate transfer

…we create a nation that’s more resilient to economic shocks and less dependent on bailouts.

Five Steps to Becoming a Financially Strong Malaysian

1. Master Your Cash Flow

Just like the government has a budget, you need one too. Track your income, expenses, and make sure you spend less than you earn.

Tip: Use apps like MAE by Maybank2u or Spendee to keep it simple.

2. Build a Solid Emergency Fund

Aim for 3–6 months of living expenses in a high-interest savings account or fixed deposit.

This reduces your reliance on credit cards or loans during emergencies, and keeps the banking system healthier.

3. Get Proper Insurance Coverage

Health crises and accidents are major causes of financial collapse for Malaysian families. A comprehensive medical card, life insurance, and critical illness coverage ensures you and your family won’t become part of the statistics.

4. Invest in Malaysia’s Growth

Consider local investment options like:

- EPF (guaranteed dividends)

- PRS (retirement savings with tax relief)

- Amanah Saham funds

- Bursa Malaysia stocks or REITs

When you invest locally, you’re literally helping build Malaysia’s economy while growing your wealth.

5. Plan Your Legacy

Estate planning (which comprises a flexible combination of wills, trusts, and nominations) ensures your wealth transfers smoothly to the next generation, avoiding costly legal disputes. This stability strengthens not just your family, but the nation’s social fabric.

A Real Malaysian Example

Case Study:

Azlan, a 45-year-old engineer in Selangor, had no medical insurance and minimal savings. When he was hospitalised for a heart condition, his RM80,000 bill wiped out his family’s savings, forcing him to take a personal loan. The stress not only affected his health but also reduced his productivity at work.

Now imagine this scenario multiplied by thousands of households, it’s not just a personal tragedy, it’s an economic drag on the nation.

At the End of the Day: Your Financial Health is a National Asset

This Malaysia Day, celebrate not just with parades and flags, but with a commitment to strengthen your personal finances.

Because when Malaysians are financially strong:

Our economy grows faster,

Our families are more secure,

Our nation becomes truly independent, not just politically, but economically.

Selamat Hari Malaysia, my fellow Malaysians!

Leave a comment